do you have to pay inheritance tax in arkansas

It is true that there is no federal inheritance tax but there is a federal estate tax. Arkansas does not collect inheritance tax.

Arkansas Health Legal And End Of Life Resources Everplans

The size of the inheritance.

. The state in which you reside. However out-of-state property may be subject to estate taxes from the state in which it is owned. Do you have to pay taxes on inheritance money.

The State of Arkansas cannot tax your inheritance. If you inherit property you dont have to pay a capital gains tax until you sell the plot. Calculate Your Retirement Taxes in These Other States.

It will be based on the value of what you. Arkansas also has no inheritance tax. 08 percent to 16 percent on estates above 1 million.

It is one of 38 states that does not apply a tax at the state level. However more-distant family members like cousins get no exemption and pay an initial rate of 15. The amount of inheritance tax that you will have to pay depends on.

Retirees hoping to pass on some of their wealth to the next generation can do so tax-free at least at the state level. Arkansas Inheritance Laws What You Should Know Smartasset Unlike gift and estate taxes which are paid by the estate before the transfer of an asset an inheritance tax is paid by the recipient of the gift after the transfer. Estate tax of 08 percent to 16 percent on estates above 5 million.

100 Money Back Guarantee. I inherited from my brother in law who passed a - Answered by a verified Tax Professional. Your relationship with the deceased.

If youre the beneficiary of a trust you must be wondering whether you need to pay taxes on a trust inheritance or not. The 2017 tax reform law raised the federal estate tax exemption considerably. This means that a beneficiary inheriting property in Arkansas will not owe any inheritance tax.

Feb 28 2022 21 min read. You have met with the trustee and the other beneficiaries whom the trustorgrantor named in the trust. This does not mean however that Arkansas residents will never have to pay an inheritance tax.

Even though Arkansas does not collect an inheritance tax however you could end up paying inheritance tax to another state. You have signed some paperwork and have received either a one-time distribution check or you may be in line for the. The percentage can range from 0 to 18 and there may be different rates for different types of property.

Inheritance tax of up to 10 percent. Arkansas does not collect inheritance tax. Before that law was enacted the exemption was 549 million per person for decedents who died in 2017.

Its up to 1206 million for people who die in 2022 2412 million for a married couple. Estate planning is complicated so you should always speak with anestate planning attorney. Generally the tax is a percentage of the value of the property being inherited.

Arkansas does not have an inheritance tax. Ad Honest Fast Help - A BBB Rated. Few taxpayers have to pay federal estate taxes but may be billed by 17 states and the District of Columbia that tax inheritances andor estate assets.

Arkansas also does not have a gift tax. If you inherit from somone who lived in one of the few states that has an inheritance tax--Iowa Kentucky Nebraska New Jersey Pennsylvannia and Maryland --you may get a tax bill from that state. However residents of Arkansas will have to pay inheritance tax if they inherit property from states that collect the tax.

The inheritance laws of another state may apply to you if you inherit money or property from a person that lives in a state that has an inheritance tax. Inheritance tax usually applies in. On the other hand Arkansas does not have an estate or inheritance tax.

Do you have to pay taxes on inheritance money. States such as Iowa New Jersey Kentucky and Pennsylvania collect inheritance tax. This does not mean however that Arkansas residents will never have to pay an inheritance tax.

Arkansas Estate Tax Everything You Need To Know Smartasset

Arkansas State Tax Refund Ar State Income Tax Brackets Taxact

Arkansas Inheritance Laws What You Should Know

Arkansas Gift Deed Form Download Printable Pdf Templateroller

What Happens If You Die Without A Will In Arkansas Cake Blog

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

Arkansas Estate Tax Everything You Need To Know Smartasset

Altura T Shirt City And Town Minnesota In Usa Beach T Shirts Buffalo T Shirts Spring T Shirts

Is There An Inheritance Tax In Arkansas

Arkansas Inheritance Laws What You Should Know

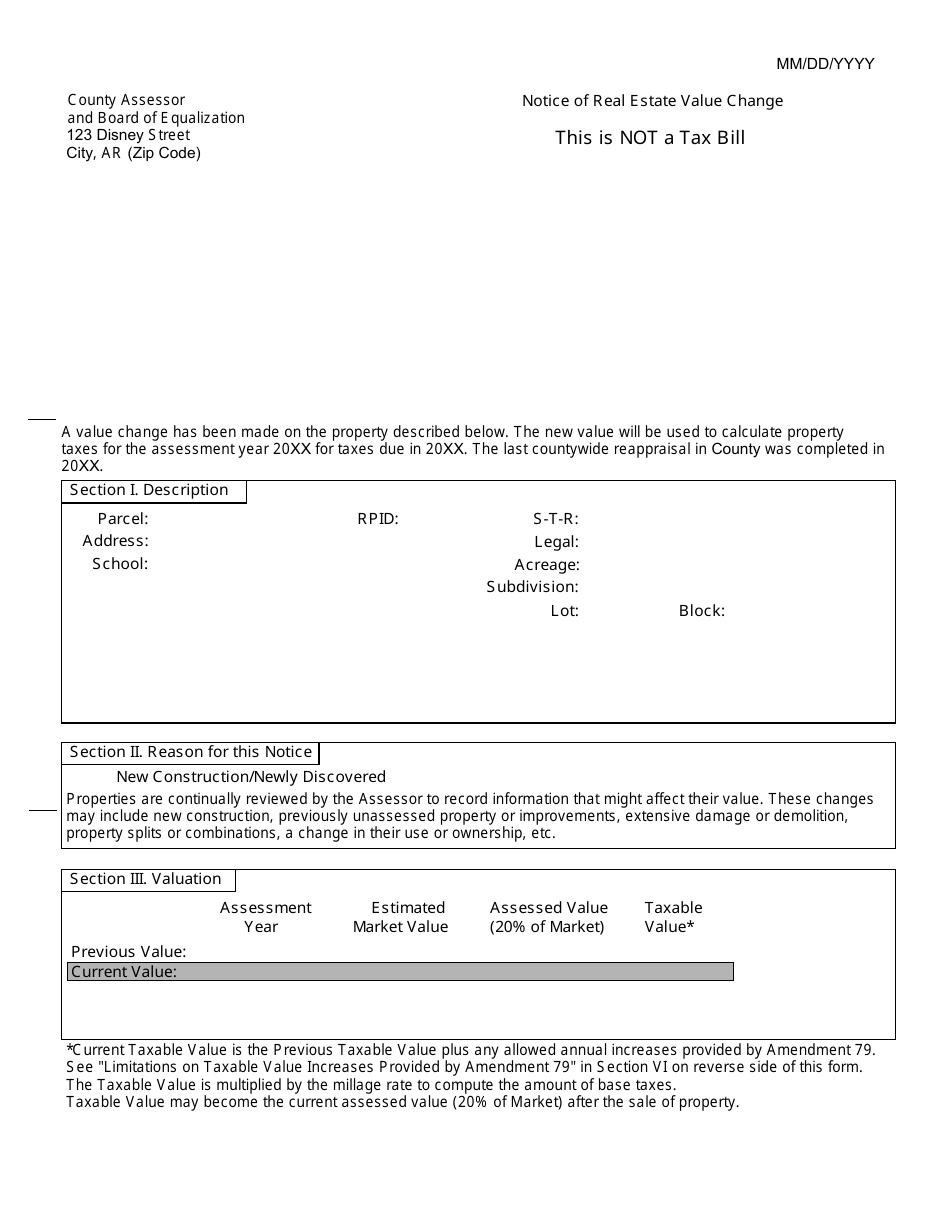

Form A 15 Download Printable Pdf Or Fill Online Notice Of Real Estate Value Change Arkansas Templateroller

Arkansas Estate Tax Everything You Need To Know Smartasset

Retirement Living In Knoxville Tennessee Knoxville Tennessee Best Places To Retire Knoxville

Arkansas State Park Map State Parks Arkansas State Arkansas

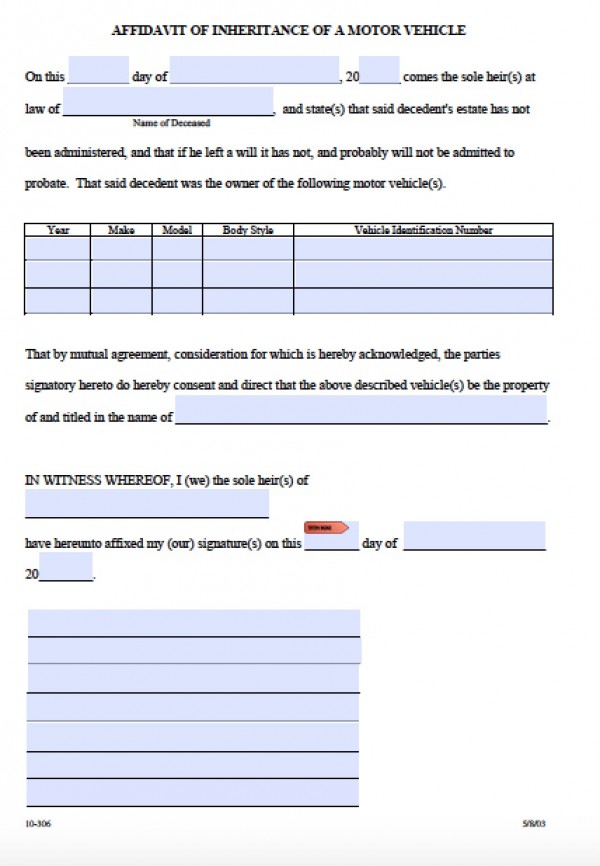

Free Arkansas Affidavit Of Inheritance Motor Vehicle Form Pdf Word