best cheap stocks to sell covered calls

But you should be aware that dividends do play a role in call option pricing. Here are a few recent strike prices that are offering a reasonable premium while still allowing for some price appreciation.

120 call while selling the Aug.

/NakedCallWriting-AHighRiskOptionsStrategy1_2-8d43ff7033cb47eca5d0954fab5c2d94.png)

. AMAT FCX GLW GPS SPLS VLO and WAG are cheap at. And then selling covered calls on the 100 shares that you own. OHI may not pay what DSL does.

Cost of your call has to be strike price difference premium received from the short call. In addition to being promising covered call candidates many of these stocks are trading at compelling valuations. If risk of a downturn is high trim some of the stock position outright at least as much.

For a free trial to the best trading community on the planet and Tylers current home. A couple weeks ago Tom Taulli of InvestorPlace wrote about 3 beaten down tech stocks that he felt were worth buying. Electronics retailer has fended off e-commerce threats and its.

128 call for a net debit of 495. Global X Russell 2000 Covered Call ETF-211 PBP. Best Stocks for Covered Calls.

This makes OPKO a great candidate for selling calls just barely. Ultimately the best covered call options are the ones where you make money consistently. Covered Calls Advanced Options Screener helps find the best covered calls with a high theoretical return.

At least 10 ITM and maybe even 15 or 20 ITM. Join 500k Active Members Who Follow Our Free Penny Stock Picks. Stay on the left side of the Moneyness slider.

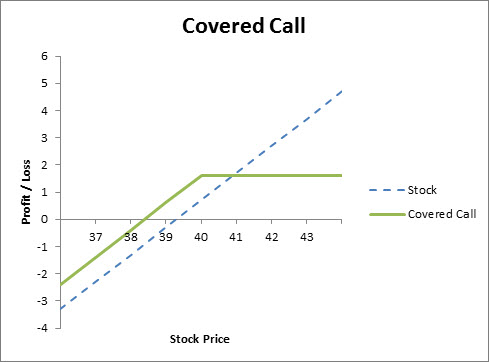

A Covered Call or buy-write strategy is used to increase returns on long. The premiums arent gigantic but if the stock isnt called away then that premium you just sold could be thought of. In theory on the day a company pays a dividend the stock should trade lower by the amount of the dividend because.

You must own at least 100 shares of a stock. Basically buy a LEAP itm call and sell short term slightly otm calls on it until it expires. If youre in a hurry below are our top picks for the best stocks for covered call writing.

Ad Penny Stock Traders Have Made Huge Profits. Best Wheel Stocks Under 10 Wheel Strategy. Global X SP 500 Covered Call Growth ETF-033 RYLD.

When I send a trade alert at Cabot Options Trader I give detailed instructions on how to execute the. Instead of just Buying Stock to Sell CCs start earlier in the process - Lets take your AAPL as example currently trading at 13537 - Right now you can Sell a Cash Secured Put on AAPL w. Lower Share Prices.

Berkshire stock may be the perfect stock for covered calls. Good stocks to write covered calls against include those whose stock price is between 5 and 20 a share. PowerShares SP 500 BuyWrite Portfolio-020 QYLD.

August 20 2021 135 Call is 267 This yields about. 28 3 Tech Stocks For Covered Calls by Mike Scanlin. Ad Sign up for the latest on how to invest in Nasdaq-100 Index Options.

Gain access to the Nasdaq-100 Index at 1100th the notional value. The Feeble Argument for Long-Term Covered Calls. When traders make a case for selling long-term options against their stock positions they usually argue that the long-term.

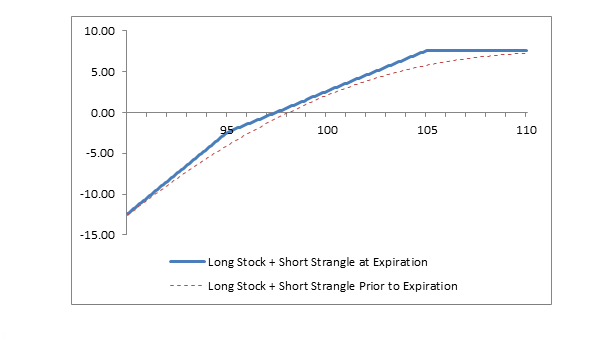

For example Consolidated Edison ED. When selling covered calls I generally recommend selling on 13 to 23 of you position. Omega Healthcare Investors yields 69 today and its dividend is well covered by the rents of its tenants who operate skilled nursing facilities.

/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

Covered Calls Basics Risks Advantages Overview

/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

Covered Calls Basics Risks Advantages Overview

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

Put Option Vs Call Option When To Sell

/NakedCallWriting-AHighRiskOptionsStrategy1_2-8d43ff7033cb47eca5d0954fab5c2d94.png)

Naked Call Writing A High Risk Options Strategy

/10OptionsStrategiesToKnow-01-10080bc58b164d78b262547662532504.png)

10 Options Strategies Every Investor Should Know

/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

Put Option Vs Call Option When To Sell

:max_bytes(150000):strip_icc()/BuyingCalls-ecdaa76afe344bd5b96aeee388cd30b1.png)

Options Trading Strategies 4 Strategies For Beginners

Covered Call Strategies Covered Call Options The Options Playbook

How To Sell A Call Option In Robinhood

:max_bytes(150000):strip_icc()/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

Covered Calls Basics Risks Advantages Overview

7 Best Options Trading Examples 2022 Benzinga

Anatomy Of A Covered Call Fidelity

Call Option Understand How Buying Selling Call Options Works

/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

Covered Calls Basics Risks Advantages Overview

/10OptionsStrategiesToKnow-01-10080bc58b164d78b262547662532504.png)

10 Options Strategies Every Investor Should Know

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Apr_2020-02-cf56d3cf2d424ade8f6001fa23883a3c.jpg)

/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

:max_bytes(150000):strip_icc()/NakedCallWriting-AHighRiskOptionsStrategy1_2-8d43ff7033cb47eca5d0954fab5c2d94.png)